Telegram id :

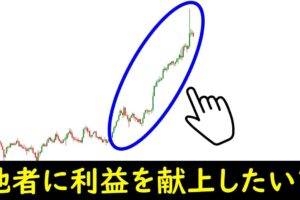

#USDCAD technical chart analysis for upcoming week #usd #usdcad #usd

The USD/CAD currency pair refers to the exchange rate between the US Dollar (USD) and the Canadian Dollar (CAD). A sell recommendation indicates that it is advisable to consider selling the USD and buying the CAD in anticipation of a decline in the value of the US Dollar against the Canadian Dollar.

The current market conditions and various factors suggest a bearish outlook for the USD/CAD pair. Here are some reasons supporting the sell expectation:

Strong Canadian Economic Data: The Canadian economy has been showing signs of strength, with positive data releases in areas such as employment, inflation, and GDP growth. This positive economic performance can bolster the value of the Canadian Dollar, putting downward pressure on the USD/CAD pair.

Commodity Prices: Canada is a major exporter of commodities, including oil, natural gas, and metals. The performance of commodity prices often has a direct impact on the Canadian Dollar, as they contribute significantly to the country’s export revenue. If commodity prices remain high or continue to rise, it can further support the CAD’s strength against the USD.

US Monetary Policy: The monetary policy actions taken by the US Federal Reserve can influence the value of the USD. If the Federal Reserve adopts a dovish stance by keeping interest rates low or implementing further quantitative easing measures, it could weaken the US Dollar relative to other currencies, including the Canadian Dollar.

Trading is an activity that involves buying and selling financial instruments such as stocks, currencies, and commodities with the aim of making a profit. However, like any other business, trading involves risks that traders must be aware of. The market is unpredictable, and no trading strategy is foolproof. Every trade carries the risk of loss, and traders must be prepared to accept that risk.

Risk in trading comes in many forms. It could be a sudden and unexpected market movement, a technical issue that disrupts trading operations, or an error in judgment by the trader. The key to managing risk in trading is to have a well-thought-out trading plan that incorporates risk management strategies. This includes setting stop-loss orders, diversifying investments, and using appropriate position sizing.

Traders should also be prepared to continuously educate themselves and stay updated on the latest market developments. This will enable them to make informed decisions and adjust their trading strategies accordingly.

In conclusion, trading is a high-risk activity that requires careful consideration and planning. While the potential for profit can be alluring, traders must always keep in mind the risk involved and take steps to manage it effectively.

Forex trading involves a significant amount of risk and is not suitable for everyone. While it can be an excellent opportunity for profit, there is always a chance of losing money. As a trader, it is essential to understand that you are solely responsible for your trading decisions and their outcomes. It is crucial to do your research, practice with demo accounts, and develop a sound trading strategy before investing real money in the market. Remember that the market is constantly changing, and it is impossible to predict future price movements with complete accuracy. Therefore, it is important to manage your risk appropriately and never risk more than you can afford to lose

コメントを残す