The Monetary Authority of Singapore (MAS) is holding its regular, bi-annual review on Oct 14.

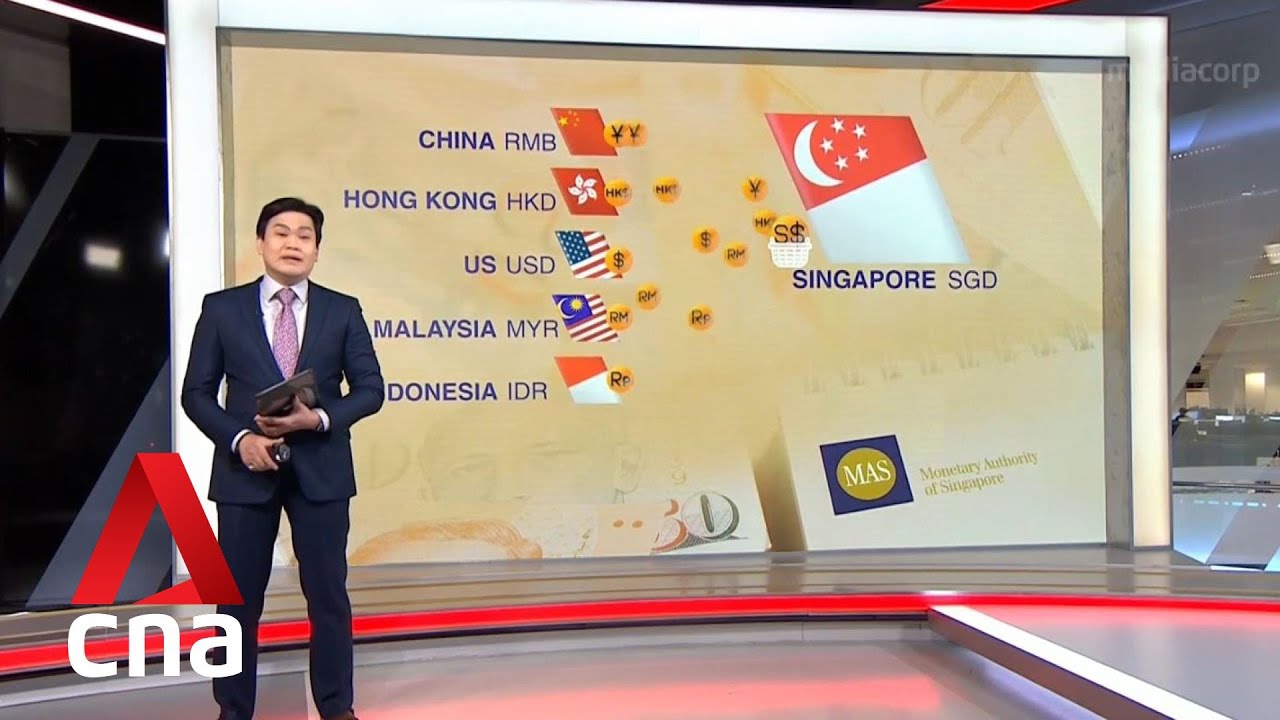

A poll of economists by Bloomberg suggests MAS may move to strengthen the Singapore dollar to curb inflationary pressures. The central bank relies on currency exchange rates and a trading band for the dollar to stabilise prices, rather than tweaking interest rates. The Singapore Dollar Nominal Effective Exchange Rate (S$NEER) is the main policy tool of MAS.

Subscribe to our channel here:

Subscribe to our news service on Telegram:

Follow us:

CNA:

CNA Lifestyle:

Facebook:

Instagram:

Twitter:

TikTok:

Laters update SGD 1.29

講华语!英文华生不知說什么?謝了。

Government intervention and currency manipulation is not the solution to our inflation problem. The world has a supply side problem and not a money supply problem. Distorting the foreign exchange market by the MAS is at best a temporary stop gap with its own corresponding negative effects. This will end up strengthening the SGD and weaken our key exports. Many of our export businesses will suffer and jobs lost in a already stressed market climate. A large segment of Singaporeans are paying the price for PAP’s personal political gains. Business associations must not allow such government intervention to hurt their bottom line. Employees of these export reliant companies have their livelihood at stake. There must be an immediate attempt by business associations to rally everyone to lobby against the PAP. Help fund nation-wide mass protest and put out anti PAP advertisements to air on national TV. Singaporeans must know of the corrupt acts of the PAP.

Lots of foreign trashes are supporting spending Singapore Reserved for one simple reason, they dont contribute to it, its not their money!!! Incompetent Government will destroy Singapore!!!!

housing is expensive :.)