Wall Street is opening a new trading week cautiously higher. Investors eventually dispelled default fears and gained confidence in the pending pause in the Fed’s aggressive monetary policy. Today, the market is focused on a series of PMIs, so a rally on Wall Street could be subdued.

The Dow Jones jumped by 700 points or 2.12%. The Nasdaq climbed by 1.07%. The S&P 500 rose by 1.45% to close at 4,282.

The major stock indices opened quietly on Monday. Futures of the US stock indices wavered between minor gains and dips in the New York pre-market. The S&P 500 is expected to trade in the corridor between 4,240 and 4,310.

The overall fundamental picture was enough to push the S&P 500 and the Nasdaq to the highest level in nearly 10 months. Besides, the Nasdaq closed with weekly gains for six weeks straight, the longest winning streak since January 2020.

The US public and private sectors showed robust hiring in May, the jobless rate increased to 3.7%, the highest rate in 7 months. All in all, conditions in the US labor market are getting weaker. Indeed, the unemployment rate rebounded from 3.4% in April, the lowest level in 53 years. It means an increase in the labor force. In turn, this eases pressure on businesses, enabling them to raise wages and drags down inflation.

Despite the employment growth, hourly earnings rise at a slow pace. The report brought relief to investors who are betting on the Fed’s pause in rate hikes at the meeting in June. It will be the first pause since the Federal Reserve launched aggressive monetary tightening more than a year ago.

Late on Thursday, the Senate passed a bill to raise the 31.4 trillion-dollar national debt ceiling. The news also had an impact on market sentiment on Friday.

The vote eased default worries. So, the VIX fear index fell to its lowest level since November 2021, slipping 1.1 to 14.6.

In the corporate sector, shares of Verizon Communications, AT&T, and T-Mobile US declined after reports that Amazon was in talks with US telecom companies to provide low-cost wireless services. Verizon shares fell by 3.2%. AT&T and T-Mobile dropped by 3.8% and 5.6% respectively, while Amazon shares added 1.2%.

All 11 sectors in the S&P 500 went up, with the materials index leading the way, having climbed by 3.4%. Consumer goods sector, which includes Amazon, trailed behind and was up 2.2%.

Nvidia shares were down 1.1% on their second day of decline after briefly entering the elite trillionaire club on Wednesday. For the week, the S&P 500 rose by 1.82%, the Dow added 2.02%, and the Nasdaq gained 2.04%.

FX Analytics –

Forex Calendar –

Forex TV from InstaForex –

Forex charts –

Instant account opening –

Forex Trading Contests –

List of official InstaForex blogs:

#forex_news #american_session #instaforex_tv

00:00 INTRO

00:34 S&P500

01:34 US

03:03 QUOTES

07:11 USDX

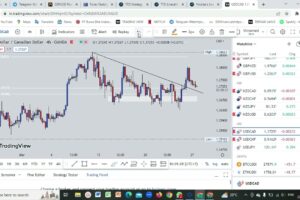

08:41 USD/CAD

09:02 OIL

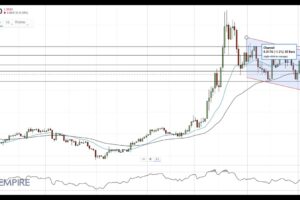

10:31 BTC/USD

コメントを残す