The USD/CHF pair is holding steady near the 0.7970 level, as traders shift their focus to the upcoming US Consumer Price Index (CPI) data — a key indicator that could shape the Federal Reserve’s next policy move. In this video, we analyze the latest price action, market sentiment, and what to expect from the highly anticipated inflation report.

A stronger CPI reading could reinforce expectations of higher-for-longer interest rates, potentially boosting the US Dollar, while a softer number might renew pressure on the greenback and lift safe-haven currencies like the Swiss Franc. We’ll explore how this data release could influence USD/CHF volatility, along with broader impacts on gold, equities, and bond yields.

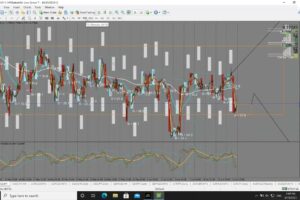

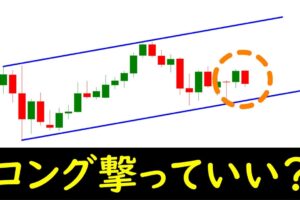

Our detailed technical analysis highlights critical support and resistance levels, short-term trading opportunities, and potential market reactions following the CPI outcome. Additionally, we’ll discuss recent economic trends in Switzerland and how the Swiss National Bank (SNB) policy outlook compares to the Fed’s.

Stay tuned to understand where USD/CHF might head next as traders prepare for a potentially market-moving CPI report.

📊 Like this video, subscribe, and turn on the bell icon for daily updates on forex trends, macroeconomic news, and market analysis.

コメントを残す