The week of sharp price moves on Wall Street is coming to an end. Today the market is having a downward correction. The major stock indices are pulling back as no more corporate reports are scheduled for today.

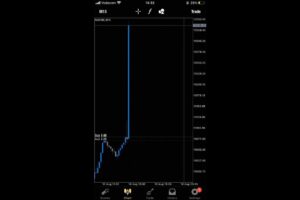

The high-tech sector propelled a steady rally on Wall Street to one-year highs. Yesterday, the sector experienced one of the worst days that certainly made a negative impact on the benchmark indices. The Dow Jones climbed by 163 points or 0.47%. The Nasdaq tumbled by 294 points or 2.05%. The S&P 500 shed 30 points or 0.68% to close at 4,534.

The stock indices traded in the green in the New York pre-market. The S&P 500 is expected to trade in the corridor between 4,520 and 4,580.

The S&P 500 and the Nasdaq fell in sync yesterday as investors reassessed their bets on a rally of high-tech stocks this year after Tesla’s and Netflix’ reports. As a result, both companies were hit by a massive sell-off.

Tesla shares plunged by 9.74%, the biggest one-day percentage drop since April 20. The streaming giant lost 8.41%, which was the biggest single-day percentage drop for Netflix since December 15.

However, the Dow was able to rise thanks to Johnson & Johnson. The company added 6.07% after publishing results and announcing an increase in full-year earnings guidance. These results helped the Dow register its ninth consecutive session of gains, the longest since September 2017.

S&P’s tech, communications services, and consumer discretionary services sectors fell at least by 2% on Thursday.

As for the state of the economy, data on Thursday showed that the labor market remains tight, while the housing and manufacturing sectors continue to fall.

On Friday, futures for US stock indices turned into a pullback, while the Dow Jones index was set to rise for the tenth day in a row.

The optimists suggest that the combination of the labor market’s strength and some rotation in industry stocks highlights hopes for a soft landing.

Pessimists reckon that the Fed has not yet finished its monetary tightening, and any further rate hike after next week will only accelerate the economic decline in 2024.

At the same time, of course, today market participants are buying up high-tech stock at bargain prices.

Tesla shares rose by 1.1% in the pre-market, Nvidia added 0.8% before the opening bell.

American Express is the only top company to report its quarterly results. While almost all other banks posted impressive results last week, American Express shed 2% before the bell after the credit card giant’s unchanged full-year profit guidance worried investors, surpassing better-than-expected quarterly results.

The S&P 500 and the Dow are on track to close the week higher. The Nasdaq might follow suit.

At the same time, it is important for investors to know that a special rebalancing of the Nasdaq 100 index will be carried out at the end of trading today. According to data from the beginning of the month, Microsoft, Apple, Nvidia, Amazon, and Tesla together account for 43.8% of the weight in the index. As part of the rebalancing, this share will decrease to 38.5%.

Wells Fargo Index strategists estimate that Starbucks, Booking Holdings, Analog Devices and several other stocks will increase their share of the Nasdaq 100 index, with changes effective from Monday.The US dollar index is consolidating gains of yesterday and trading higher. After a 0.10% uptick today, the index is trading at 100.99 now. The intraday corridor is seen between 100.5 and 101.3.

On Thursday, the US currency enjoyed a stunning rally. It had the strongest intraday performance and perhaps weekly performance in more than two months.

After the first really nervous day in financial markets in weeks, Friday’s recovery suggests that the pullback in stocks and bonds and the steady dollar rally was more of an exception than a rethink.

FX Analytics –

Forex Calendar –

Forex TV from InstaForex –

Forex charts –

Instant account opening –

Forex Trading Contests –

List of official InstaForex blogs:

#forex_news #american_session #instaforex_tv

00:00 INTRO

00:34 S&P500

01:09 QUOTES

02:24 USD

04:46 USDX

06:03 USD | CAD

06:59 CANADA RETAIL SALES, M/M (MAY)

07:00 OIL

07:10 BTC | USD

07:38 CRYPTO

㊹ 【ダイジェスト版】第115回『ザッ 資産運用!』-2023年7月22日 LIVE開催

㊹ 【ダイジェスト版】第115回『ザッ 資産運用!』-2023年7月22日 LIVE開催

コメントを残す