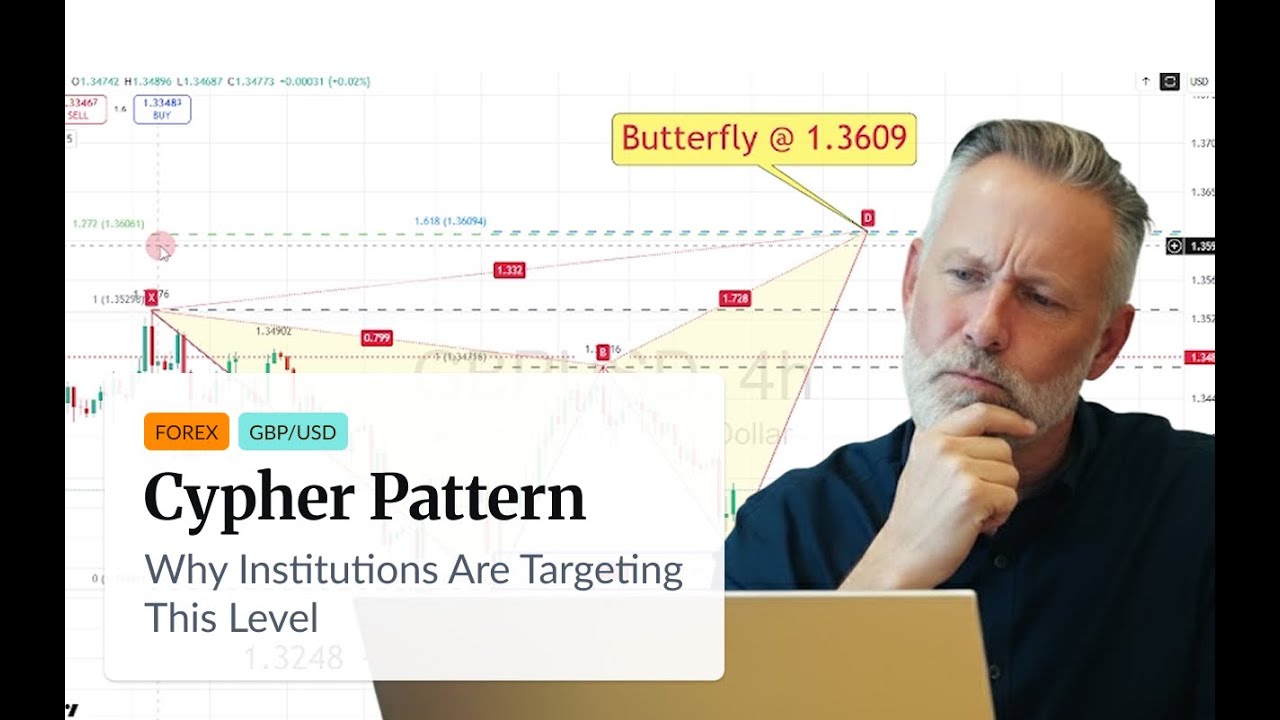

The British Pound is setting up a bullish Cypher pattern against the US Dollar, with institutional traders eyeing the Demand Zone at 127.2% and 161.8% Fibonacci extensions for long entries. FXStreet Senior Analyst Ian Coleman breaks down why the IMF’s UK inflation forecast and Fed easing cycle support this setup, identifies optimal liquidity zones near previous swing lows, and reveals the exact invalidation level for this Butterfly pattern.

Chapters:

0:00 Intro

0:40 GBP/USD bullish fundamentals

1:25 GBP/USD technical analysis

2:52 GBP/USD bullish setup

Are you waiting for the Demand Zone entry, or are you already positioned long on GBP/USD? Drop your entry level and target below📊👇

GBP/USD Technical Analysis by Ian Coleman | FXStreet

For a more in-depth analysis:

—————————————————————————————–

👍 Hit the like button if you liked the video.

🔔 Subscribe for more daily news and updates

💬 Drop your price target for this week in the comments!

Find more expert insights and updates on Crypto and Forex on our website:

News:

Analysis:

Economic Calendar:

Cryptocurrencies:

Broker reviews:

Best of the Year:

You can also join our Orange Juice Newsletter:

Orange Juice:

And don’t forget to follow us on Social Media:

Instagram:

TikTok:

Facebook:

LinkedIn:

X:

Join our communities for real-time forex insights:

Telegram –

WhatsApp –

📲 Download our App to stay tuned on all news around the financial markets!

Apple Store:

Google Play Store:

#gbpusd #forextrading #cypherpattern #technicalanalysis #swingtrading

—————————————————————————————–

The information in this video is for educational and informational purposes only and does not constitute investment advice. Trading Forex and other financial instruments involves significant risk of loss. FXStreet and the presenter do not guarantee the accuracy or completeness of this information and accept no liability for any losses arising from its use. The views expressed are solely those of the author and do not necessarily reflect the opinions of FXStreet or its partners.

コメントを残す