Welcome to FXTech’s comprehensive analysis of the CHF/JPY currency pair for October 13-18, 2025. In this video, we examine the significant technical breakout above 187.50, analyze key market-moving events, and provide actionable trading strategies for both short-term and medium-term timeframes.

📊 What’s Covered in This Analysis:

•

Current market overview and performance metrics

•

Key technical breakout analysis at 187.50 resistance

•

Important news summary: US-China trade tensions, Fed easing signals, and safe-haven dynamics

•

Daily price action analysis for October 13-18

•

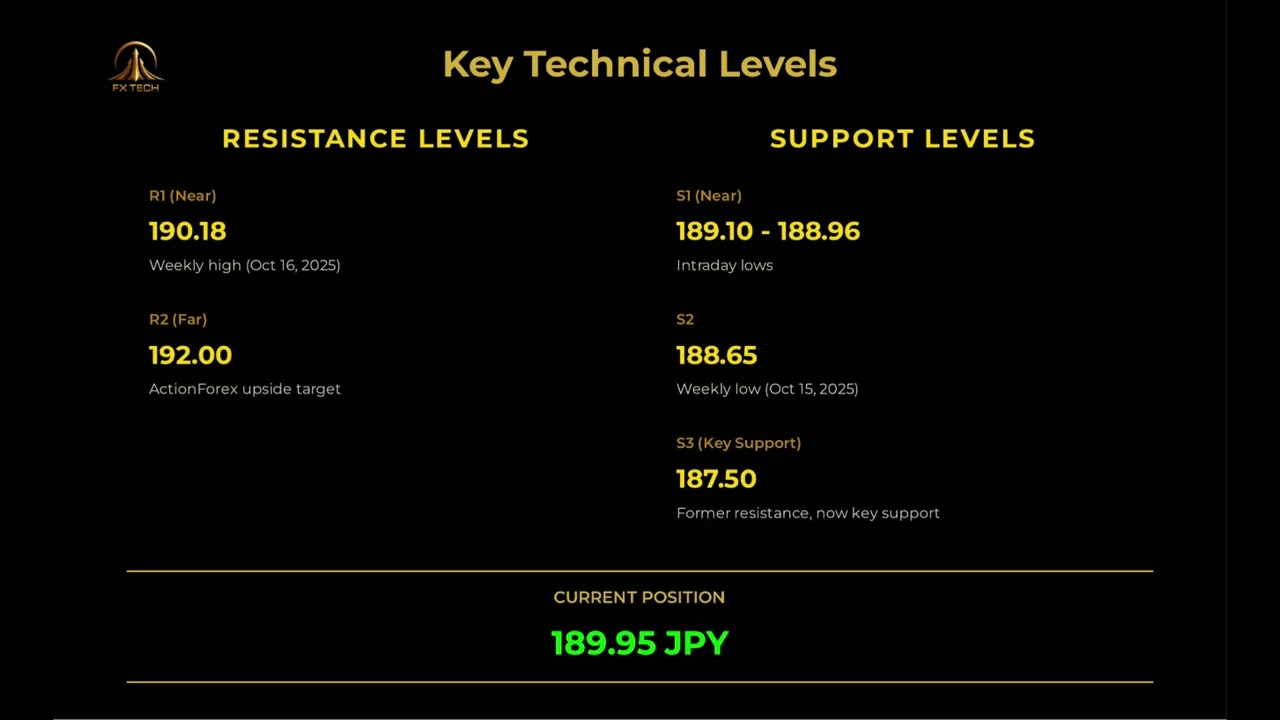

Critical support and resistance levels

•

Short-term trading strategies (1-2 weeks)

•

Medium-term outlook (1-3 months) with probability-weighted scenarios

•

Comprehensive risk factor analysis

•

Trading discipline and risk management recommendations

🎯 Key Findings:

•

CHF/JPY broke critical resistance at 187.50 on October 8, 2025

•

Next upside target: 192.00

•

Short-term range: 188.50 – 190.50

•

Medium-term bullish scenario (65% probability): 191.00 – 192.50

•

Safe-haven dynamics dominate amid US-China trade tensions

📈 Data Sources: This analysis synthesizes insights from five leading financial platforms:

•

TradingView

•

investingLive (formerly Forexlive)

•

ActionForex.com

•

FOREX.com

•

DailyForex

⚠️ Risk Disclaimer: Trading foreign exchange carries a high level of risk and may not be suitable for all investors. The analysis presented in this video is based on data as of October 20, 2025, and market conditions may change rapidly. Always implement proper risk management, never risk more than 2% of your account on a single trade, and consider seeking advice from a qualified financial advisor before making trading decisions.

#ForexTrading #CHFJPY #TechnicalAnalysis #ForexStrategy #SafeHaven #SwissFranc #JapaneseYen #ForexEducation #TradingStrategy #RiskManagement #FXTech #CurrencyTrading #ForexAnalysis #MarketAnalysis #TradingTips

コメントを残す