The USD/CHF pair is showing signs of recovery after touching a two-week low, bouncing slightly above the mid-0.7900s zone. In this video, we analyze the key drivers behind the recent price action and discuss whether the recovery in the US Dollar (USD) against the Swiss Franc (CHF) can sustain in the near term.

The Greenback’s modest rebound comes as traders digest mixed US economic data and shifting expectations around the Federal Reserve’s next policy steps. Meanwhile, safe-haven demand for the Swiss Franc remains relatively subdued amid improved global risk sentiment and easing geopolitical tensions, limiting CHF gains.

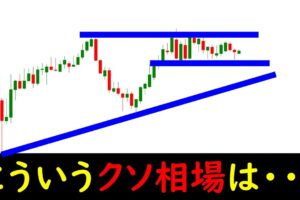

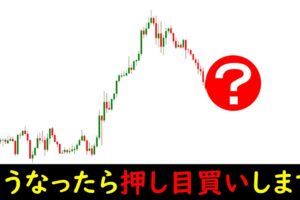

From a technical standpoint, the USD/CHF pair faces immediate resistance near 0.7980, while support lies around 0.7920. A break above the resistance could open the path toward the 0.8000 psychological level, whereas sustained weakness below support may invite renewed selling pressure.

We’ll also cover how movements in US Treasury yields, global risk appetite, and central bank commentary are shaping the broader market tone.

Join us as we review detailed chart patterns, discuss short-term trading setups, and share expert insights to help you navigate the USD/CHF market effectively. Don’t forget to like, comment, and subscribe for daily forex updates and professional analysis!

コメントを残す