In the first week of August, the forex market is closely watching the UK Construction PMI and Canada’s Unemployment Rate, alongside price movements in major currency pairs and gold. With UK PMI expected to remain below 50 and Canada’s unemployment rate forecast to tick higher to 7%, what could this mean for GBP/USD and USD/CAD?

This Forex Weekly Recap breaks down key macroeconomic data, price action, and trade setups so you can prepare for the trading week ahead. But first, let’s look back at last week’s major releases and how they moved the market.

Previous Week (July 31 – Aug 1, 2025) Macroeconomic Events & Market Recap

Canada GDP m/m (–0.1%): Back-to-back monthly contractions highlight Canada’s fragile economy, weighing on CAD and pushing USD/CAD higher.

U.S. Non-Farm Payrolls (+73K vs. 106K forecast): Below expectations, signaling labor market weakness and sparking a sharp 200-pip rally in EUR/USD.

Previous Week Technical Recap

EUR/USD: Bounced from old support, forming a bullish leg, though further downside possible before another rebound.

USD/CHF: Continued downtrend, but signs of potential recovery as CHF strength slows.

Current Week (Aug 6–8, 2025) Key Events & Market Outlook

UK Construction PMI (Forecast: 49.2, Prev: 48.8): Still in contraction; outcome will guide GBP/USD direction.

Canada Unemployment Rate (Forecast: 7.0%, Prev: 6.9%): Labor market softening could pressure CAD if higher-than-expected.

Current Week Technical Setups

EUR/USD: Testing support on the 4H chart; potential for further weakness.

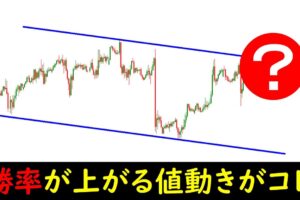

GBP/USD: Hovering near key support; downside risk if level breaks.

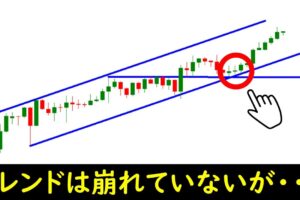

USD/CAD: Retested breakout level, trending higher with bullish momentum.

XAU/USD (Gold): Weekly trend remains up, but price shows potential for decline if it fails the daily breakout retest.

🔔 Don’t forget to subscribe and hit the notification bell to stay updated on our forex weekly recap and insights!

📈 Join our traders’ community for exclusive updates:

Facebook:

Instagram:

Website:

Timestamps:

00:00 Introduction

04:13 Canada GDP m/m – Two Months of Contraction, USD/CAD Moves Higher

08:31 U.S. NFP at 73K – EUR/USD Surges +200 Pips

16:00 EUR/USD Technical Outlook – Support Retest Ahead?

16:47 USD/CHF – Persistent Downtrend, Signs of Recovery

19:02 UK Construction PMI Preview – What It Means for GBP/USD

22:31 Canada Unemployment Rate Forecast – Impact on USD/CAD

27:54 EUR/USD Near-Term Weakness Possible

28:30 GBP/USD Testing Key Support Area

29:36 USD/CAD Breakout Retest, Bullish Momentum Builds

30:18 Gold (XAU/USD) – Weekly Uptrend, Daily Breakdown Risk

31:30 Closing Remarks

#TRUCAST #TradersUnited #TRUORG #forexrecap #forexweekly #ForexTrading #LiveTrade #Macroeconomics

Disclaimer:

The content presented in this TRUCast webinar is intended for educational and informational purposes only. Nothing discussed should be considered financial advice, investment recommendations, or an offer to buy or sell any securities. All opinions expressed are those of the speakers and do not necessarily reflect the views of Traders United or its affiliates.

Investing and trading involve risk, including the potential loss of capital. Past performance does not guarantee future results. TRU is not liable for any financial decisions made based on the content of this webinar.

コメントを残す