A 9% move in the Swiss Franc isn’t just rare—it’s historic. And it’s sending shockwaves through the global economy.

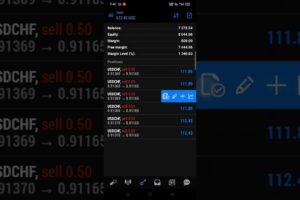

In April 2025, the U.S. imposed tariffs on Swiss luxury imports, and the forex market exploded. Investors rushed to the Swiss Franc (CHF), triggering its biggest rally since 2008.

But this isn’t about Switzerland—it’s a signal that U.S. economic dominance is cracking. When America weaponizes trade, the world looks for alternatives. This is a textbook case of de-dollarization in real time. Learn why this matters for your trades, your money, and your future.

Subscribe for clear, no-fluff breakdowns of global macro shifts, currency plays, and real trader insights. Stay ahead of the move.

#SwissFranc #USDCHF #CurrencyWar #DeDollarization #ForexNews #GlobalEconomy #TariffNews #TradingInsights #MacroAnalysis #DollarCollapse #SafeHavenAssets #ForexStrategy #USDvsCHF #GeopoliticsAndMarkets #ViralVideo #UnitedStates #Fyp #Viral #TrendingVideo #ForYouPage

Chapters

00:00 – Swiss Franc Spikes 9% — Here’s Why

00:10 – What Triggered the Move: U.S. Tariffs on Swiss Goods

00:20 – Investors Panic — Safe Haven Currency Surge

00:30 – Why This Is Bigger Than Just Switzerland

00:40 – The Dollar’s Credibility Is Cracking

00:50 – The Next Phase of De-Dollarization Has Begun

コメントを残す