United States vs. Canada

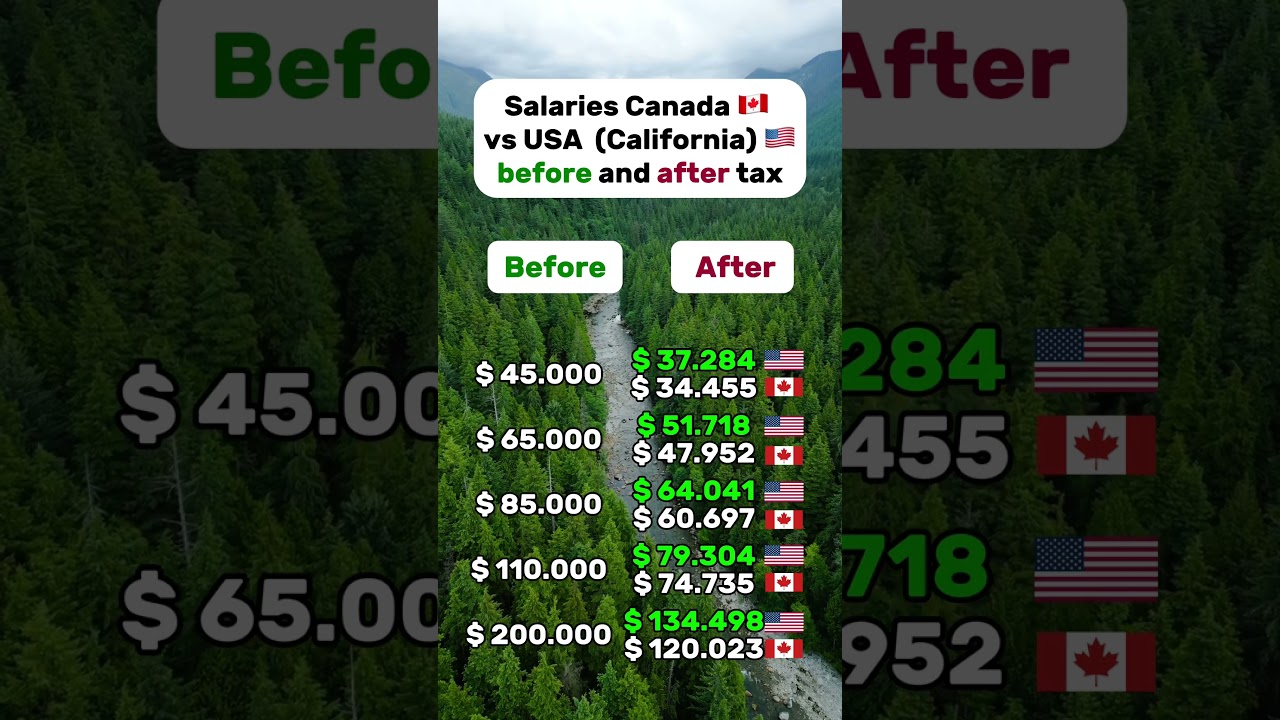

United States vs. Canada  – Two neighbors, two different tax systems. Let’s compare net salaries to see how far your paycheck goes in California and Ontario.

– Two neighbors, two different tax systems. Let’s compare net salaries to see how far your paycheck goes in California and Ontario.  All gross salaries are in USD.

All gross salaries are in USD.

45.000 Gross Per Year

45.000 Gross Per Year

United States: $ 37.284

United States: $ 37.284

Canada: ~$ 34.455 (50.169 CAD)

Canada: ~$ 34.455 (50.169 CAD)

At this level, California taxes ~17.2%, while Ontario taxes ~23.4%.

65.000 Gross Per Year

65.000 Gross Per Year

United States: $ 51.718

United States: $ 51.718

Canada: ~$ 47.952 (69.821 CAD)

Canada: ~$ 47.952 (69.821 CAD)

The US effective tax rate is ~20.4%, compared to Ontario’s ~26.2%.

85.000 Gross Per Year

85.000 Gross Per Year

United States: $ 64.041

United States: $ 64.041

Canada: ~$ 60.697 (88.379 CAD)

Canada: ~$ 60.697 (88.379 CAD)

At this level, California taxes ~24.6%, while Ontario taxes ~28.6%.

110.000 Gross Per Year

110.000 Gross Per Year

United States: $ 79.304

United States: $ 79.304

Canada: ~$ 74.735 (108.820 CAD)

Canada: ~$ 74.735 (108.820 CAD)

The US effective tax rate is ~27.9%, compared to Ontario’s ~32.1%.

200.000 Gross Per Year

200.000 Gross Per Year

United States: $ 134.498

United States: $ 134.498

Canada: ~$ 120.023 (174.762 CAD)

Canada: ~$ 120.023 (174.762 CAD)

At this level, California taxes ~32.8%, while Ontario taxes ~40%.

Market Insights:

Market Insights:

United States (California): The US job market offers higher salaries in many industries, especially in tech, finance, and healthcare. Companies compete aggressively for talent, which often means better total compensation, including bonuses and stock options. However, employees need to pay for healthcare, and housing costs in major cities are steep.

United States (California): The US job market offers higher salaries in many industries, especially in tech, finance, and healthcare. Companies compete aggressively for talent, which often means better total compensation, including bonuses and stock options. However, employees need to pay for healthcare, and housing costs in major cities are steep.

Canada (Ontario): Salaries tend to be lower than in the US, but job security, public healthcare, and social benefits offer extra value. The market is stable, with strong demand in tech, finance, engineering, and research. Housing in major cities like Toronto is expensive, but costs vary by region, with more affordable options in smaller cities.

Canada (Ontario): Salaries tend to be lower than in the US, but job security, public healthcare, and social benefits offer extra value. The market is stable, with strong demand in tech, finance, engineering, and research. Housing in major cities like Toronto is expensive, but costs vary by region, with more affordable options in smaller cities.

Hockey or

Hockey or  Surfing? Maple syrup or peanut butter? Let us know your pick!

Surfing? Maple syrup or peanut butter? Let us know your pick!

The research is based on publicly available data. Deviations are possible.

Ready to take your tech career to a global scale? Book a career counseling session with us and secure a superior job, earn a higher salary, or relocate to a new place—with our help.

Ready to take your tech career to a global scale? Book a career counseling session with us and secure a superior job, earn a higher salary, or relocate to a new place—with our help.

Like,

Like,  share, &

share, &  follow for more career tips & job advice!

follow for more career tips & job advice!

#vancouver #taxes #salary #usalife #canadalife #sanfrancisco

口先介入が入る度にチャンスになる!?

口先介入が入る度にチャンスになる!?

香港ドル両替

香港ドル両替 30,000台湾元 → 6,900香港ドル(約14万円)

30,000台湾元 → 6,900香港ドル(約14万円)

Better than getting billed for a hospital visit…

Much better financially in Canada including healthcare and education. But don’t expect the ignoring dolts supporting fuhrer Trump to comprehend it.

They’re both wrong. No one should be giving up 35% of their income to a pack of government dooshbags.

In canada health and education is free unlike USA. So need to deduct health insurance from USA salary to get the exact difference.

Take off the 1200 plus a month for health insurance

Free heart surgery and rehab free 3 months ICU for premature baby, free colonoscopies, free MRI and neurology etc etc and service with a smile Go Canada Go, the greatest country in the world.

Yeah and my Medicare here in the United States they’re pulling about $228 a month out of my 1400 a month SSI I didn’t know I would have to pay for it I thought I earned it with all those years I paid in

Not one person in Canada goes bankrupt due to medical bills. Also US national debt ratio to GDP is twice that of Canada’s. Add that to the fact that no elementary school child in Canada has ever been subjected to a school shooting… I’d say I’d take Canada over the US every day all day.