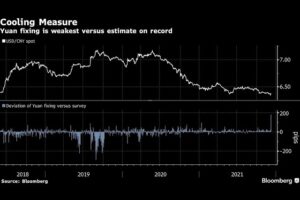

China is rewriting the rules of global finance with its ambitious currency swap agreements. From Saudi Arabia to Nigeria, Argentina to the European Union, these strategic moves are designed to internationalize the renminbi (RMB) and challenge the dominance of the US dollar in global trade.

In this video, we explore how these agreements work, their impact on global markets, and what they mean for the US economy. Discover how China’s partnerships with over 40 nations, including major deals with Saudi Arabia, Russia, and Brazil, are reshaping financial dynamics.

We also delve into the geopolitical implications of RMB-based transactions, the challenges to US sanctions, and the potential decline of the US dollar as the world’s reserve currency.

Stay tuned as we break down the key players, the strategic motivations, and the future of global currency dominance.

👉 **Like** this video if you enjoyed it.

💬 **Comment** below with your thoughts on China’s growing influence.

🔔 Don’t forget to **subscribe** for more insights on global economics and geopolitics!

コメントを残す