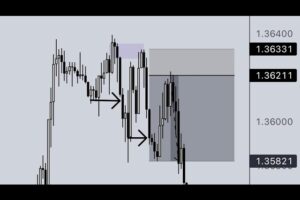

USD/CAD is trading just below the key resistance level of 1.3600 as the market awaits the outcome of the Federal Reserve’s highly anticipated monetary policy meeting next Wednesday. The pair remains range-bound, with the US Dollar bulls facing a tough battle at the 1.3600 level. The Federal Reserve is expected to cut interest rates as concerns grow about weakening labor market conditions. The central bank is confident inflationary pressures will return to its 2% target.

On the Canadian side, a recovery in Oil prices has failed to boost the Canadian Dollar (CAD), as the Bank of Canada (BoC) is likely to continue its aggressive policy-easing stance. The BoC has already cut interest rates by 75 basis points and may reduce them further as economic conditions in Canada struggle to improve. This divergence between the Fed’s policy approach and the BoC’s more aggressive rate cuts adds complexity to the USD/CAD market.

This video provides an in-depth analysis of the current market dynamics and what to expect from the Fed’s decision and the BoC’s ongoing policy shifts. Learn how these key factors will influence the USD/CAD pair in the near future and the importance of the 1.3600 resistance level for traders.

#USDCAD #ForexAnalysis #USFedPolicy #CanadianDollar #KeyResistance

Live Signals Videos:

Weekly update: GBPJPY:

Website:

Instagram:

Facebook:

Twitter:

コメントを残す