As we enter September, the anticipation for this week’s Non-Farm Payroll (NFP) report is palpable. Despite battling a rough patch health-wise, I couldn’t stay away from the action any longer. After a brief absence, I’m back, eager to dive into what promises to be a crucial week for the markets.

The big question on everyone’s mind is the NFP, scheduled for release this Friday. This report has the potential to significantly impact market sentiment, particularly as we continue to navigate the uncertainties surrounding the Federal Reserve’s next move. My hunch is that we could see a lower-than-expected NFP figure, suggesting a cooling economy. This could nudge the Fed toward a more dovish stance, possibly even hinting at a rate cut in the near future.

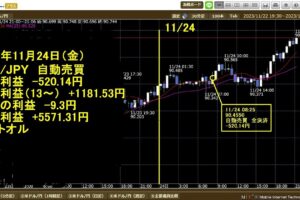

Switching gears to the Japanese yen, we’ve witnessed some remarkable movements during the Asian trading sessions, with significant strengthening across pairs like AUD/JPY and NZD/JPY. The yen’s resurgence seems tied to speculation around another potential rate hike from the Bank of Japan, as hinted by Governor Ueda. The currency’s renewed strength could present trading opportunities as the market adjusts to this possibility.

Meanwhile, the US dollar has shown signs of depreciation, pulling back notably against the euro. After breaking the 1.10 level, the EUR/USD pair has retraced some of its gains but remains within a key trading range of 1.10 to 1.15. With the dovish undertones from the Fed, I anticipate that the euro could reclaim the 1.12 level before the year’s end.

But all eyes remain on the NFP. Market expectations hover around 164,000 jobs added, but I’m leaning toward a lower figure, perhaps in the 110,000 to 120,000 range. A weaker NFP could bolster the case for a 25 basis point rate cut by the Fed, further weakening the dollar and potentially setting the stage for a euro rally.

In conclusion, this week’s NFP report could be a game-changer, potentially steering the Fed’s hand and influencing global currency markets. As always, I’m keen to discuss these developments further during our upcoming webinar, where we’ll dive deeper into the implications of the NFP and what it might mean for our trading strategies. Don’t miss out—register now, and let’s navigate this exciting week together.

Register here for the next webinar:

Join Luca’s Telegram Trading Feed:

Free Trading eBook Series:

Catch up with the latest news and market analysis here:

Get in touch today:

Web:

Twitter:

Facebook:

Spotify:

Phone:

Australia

1300 729 171

International

+61 2 9188 2999

#acysecurities #NFPweek #nonfarmpayroll #nonfarm #keylevels #forexanalysis #forex #trading #analysis #audjpy #audusd #eurgbp #eurusd #eurjpy #gbpjpy #gbpusd #nzdjpy #nzdusd #usdcad #usdchf #usdjpy #usdollar #gold #xauusd #sp500 #nas100 #bitcoin #btcusd

@ACYSecuritiesAustralia

Foreign exchange and derivatives trading carries significant risk and is not suitable for all investors. You do not own, or have any interest in, the underlying assets.

Before you decide to trade foreign exchange and derivatives, we encourage you to consider your investment objectives, your risk tolerance and trading experience.

ACY Securities Pty Ltd (AFSL: 403863) provides general advice that does not consider your objectives, financial situation or needs. You should consider if you are part of our Target Market by reviewing our TMD and read our FSG and PDS to ensure you fully understand the risks. The content of this presentation must not be construed as personal advice and the information in this presentation is prepared without considering your objectives, financial situation or needs; please seek advice from an independent financial or tax advisor if you have any questions.

ACY Securities Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC AFSL:403863). Registered address: ACY Tower, Level 18, 799 Pacific Hwy, Chatswood NSW 2067. AFSL authorised us to provide financial services to Australian Residents or Businesses.

ACY Capital LLC (‘ACY LLC’), ACY LLC is incorporated in St Vincent and the Grenadines (Company number: 2610 LLC 2022). Registered address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown.

© 2018 – 2024 ACY Securities is a brand name of ACY AU and ACY LLC, ACY Securities Pty Ltd. All rights Reserved.

Get well lucas

Please subscribe, like, comment, & share!

Hi Traders, Register here for this week’s free Forex trading webinars

Disclaimer: Trading involves risk.