🔥Download My FREE Forex Robots and my Extensive Forex Trading Guides for Beginners and Advanced Traders 👉

The Foreign Exchange Market (Forex) offers vast opportunities for traders of all levels, from novices exploring swing trading to seasoned professionals executing complex strategies. Whether you’re intrigued by Bitcoin’s volatility or prefer traditional currency pairs like GBP/USD and EUR/USD, understanding effective strategies is key to success. The Forex market is the global marketplace for buying and selling currencies. Swing trading is a popular approach among Forex traders due to its focus on capturing short to mediumterm price movements.

Unlike day trading, which involves rapid buying and selling within a single trading session, swing trading allows traders to hold positions for several days or weeks to capitalize on price swings. Trend trading is based on the principle that asset prices tend to move in a particular direction over time. Traders identify downtrends (falling prices)—using technical analysis tools like Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI). Trend trading strategies aim to capitalize on sustained price movements, making it a cornerstone of many successful trading approaches.

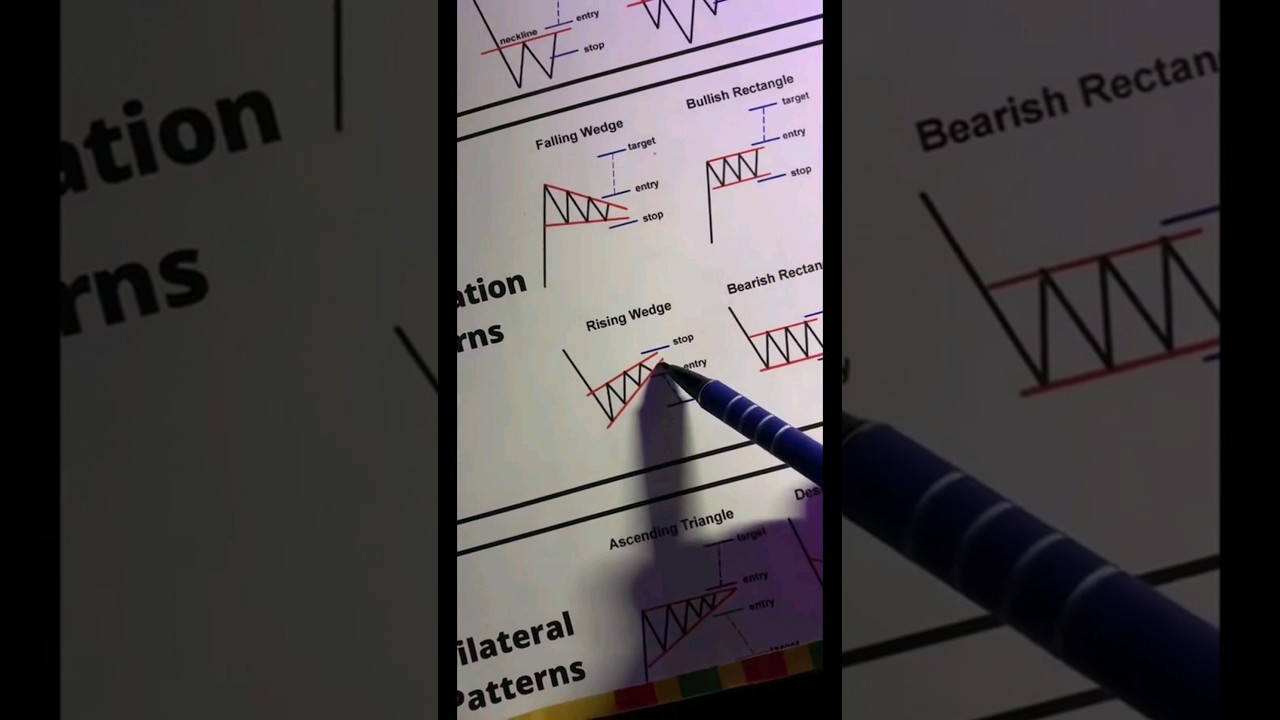

Reversal strategies aim to predict when a trend is about to change direction. Traders look for signals that indicate a potential reversal, such as overbought or oversold conditions identified by indicators like RSI or stochastic oscillators. Continuation patterns signal that the prevailing trend is likely to continue after a brief consolidation or retracement. Consolidation occurs when prices move within a defined range, often forming a rectangle or sideways channel on the price chart. Range trading strategies involve buying at support levels and selling at resistance levels until the price breaks out of the consolidation phase.

Chart patterns provide visual clues about future price movements based on historical price data. Triangles (such as ascending, descending, and symmetrical triangles) and wedges are common patterns that signal potential breakouts or breakdowns. Fibonacci Retracement Used to identify potential reversal levels based on the Fibonacci sequence. RSI (Relative Strength Index) Measures the speed and change of price movements, indicating overbought or oversold conditions. MACD (Moving Average Convergence Divergence) Combines moving averages to signal changes in the strength, direction, momentum, and duration of a trend. Commonly traded pairs include:

EUR/USD Euro against US dollar.

USD/JPY US dollar against Japanese yen.

GBP/USD British pound against US dollar.

AUD/USD Australian dollar against US dollar.

USD/CHF US dollar against Swiss franc.

USD/CAD US dollar against Canadian dollar.

GBP/JPY British pound against Japanese yen.

EUR/JPY Euro against Japanese yen.

For traders seeking higher win rates and accuracy, advanced strategies such as scalping offer opportunities to profit from rapid price movements within short timeframes. Traders incorporate Autonomous Sensory Meridian Response (ASMR) techniques to enhance focus and relaxation during trading sessions. ASMR, characterized by tingling sensations triggered by specific audio or visual stimuli, can promote a calm trading environment conducive to making informed decisions. Mastering Forex trading requires a combination of technical knowledge, strategic acumen, and psychological discipline. By integrating fundamental analysis, technical indicators, and chart patterns into your trading approach, you can navigate the complexities of the Foreign Exchange Market

Thanks for watching, like, sub and comment! @ForexWarriorsOfficial

コメントを残す