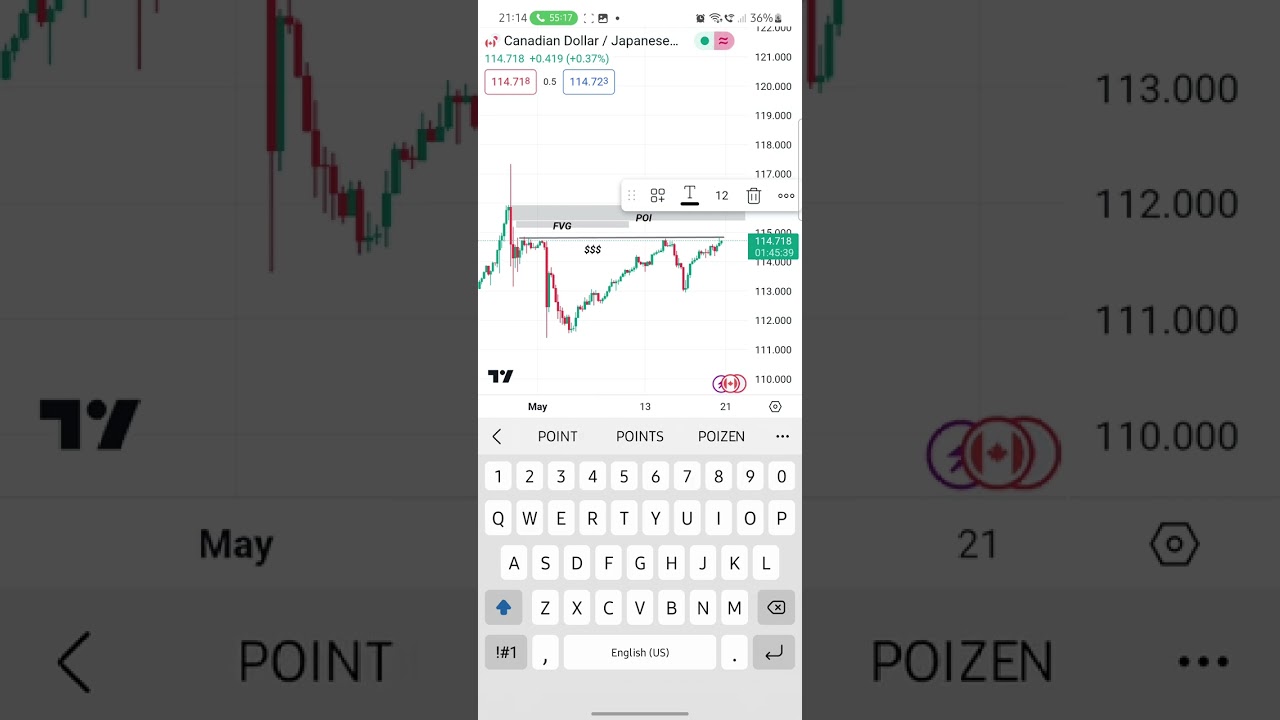

Here’s a breakdown of the CAD/JPY currency pair ¹ ²:

*Overview:*

– The CAD/JPY currency pair is a strong substitute for the USD/JPY pair when a trader is wary of trading the U.S. dollar.

– CAD/JPY is historically more sensitive to changes in market-wide sentiment than USD/JPY due to the historically higher yield attached to the Canadian dollar.

– The Canadian dollar, or ‘Loonie,’ is affected by oil prices because of Canada’s energy exports.

*Recent news:*

– The Japanese yen took the spotlight after a surprise policy move from the Bank of Japan.

– The Bank of Japan stunned the markets by raising the cap on 10-year Japanese bond yields to 0.50% from 0.25%.

– The Bank of Canada comes out swinging with a 25bps hike, and USD/CAD slides.

*Technical analysis:*

– The trend favors CAD/JPY bears at the moment.

– The pair has been slowly grinding lower since the bearish signals in early November and settled into a consolidation pattern between 99.50 and 101.00 before breaking lower on the BOJ news.

– If you’re considering a bearish position on CAD/JPY, there could be potential resistance around the previous consolidation/falling SMAs if retested, an area to consider shorting to improve the potential return-on-risk.

*Other information:*

– For those who don’t see the market making its way all the way back up to that area, scaling-in at various levels up to that area is an entry strategy to consider as well, especially with Canadian inflation ahead.

#- A logical stop area would be above the consolidation area pattern, but for the more conservative traders or longer-term players, setting a stop above the falling 200 SMA makes sense as well if you’re willing to give up some potential return.

– As for potential profit targets, there aren’t any recent support levels to point to, but using the average weekly volatility range of 2.83, potential buying support may appear between 94.00 to 96.00 in the short-to-medium #term.

コメントを残す